Japan Interest Rates: Current Levels, History, And Economic Impact

Japan Interest Rates: Current Levels, History, And Economic Impact

Editor's Notes: Japan Interest Rates: Current Levels, History, And Economic Impact have published today date. Interest rates play a crucial role in driving the economic growth of any nation. In the case of Japan, interest rates have been a subject of keen interest, given the country's prolonged period of low economic growth. This guide delves into the current levels, historical trends, and economic impact of interest rates in Japan.

To help our readers understand Japan's Interest Rates: Current Levels, History, And Economic Impact, we deep dive into research, analyzed, and dug out information, made Japan Interest Rates: Current Levels, History, And Economic Impact we put together this Japan Interest Rates: Current Levels, History, And Economic Impact guide to help target audience make correct decision.

Key differences or Key takeways

Mortgage Rates Remain at Historic Lows - Source www.beyondseattle.com

Transition to main article topics

FAQ

The following are some frequently asked questions about interest rates in Japan:

Navigating Mortgage Lending Rates Your Comprehensive Guide - Source nolvamedblog.com

Question 1: What are the current interest rates in Japan?

Answer: As of [insert date], the Bank of Japan's short-term interest rate (the overnight call rate) is -0.1%. Japan Interest Rates: Current Levels, History, And Economic Impact The long-term interest rate (the 10-year Japanese government bond yield) is at 0.25%.

Question 2: How have interest rates changed in Japan over time?

Answer: Interest rates in Japan have been very low for many years. The Bank of Japan first introduced negative interest rates in January 2016, and they have remained negative ever since.

Question 3: What is the impact of low interest rates on the Japanese economy?

Answer: Low interest rates can have a number of impacts on the economy, including:

- Increased borrowing and spending

- Higher asset prices

- Reduced economic growth

- Increased government debt

The impact of low interest rates on the Japanese economy is a complex issue, and there is no consensus among economists about the overall effects.

Question 4: What is the outlook for interest rates in Japan?

Answer: The Bank of Japan is expected to keep interest rates low for the foreseeable future. The central bank has said that it will not raise rates until inflation reaches 2%, and inflation is currently well below that level.

Question 5: What are the risks of keeping interest rates low for too long?

Answer: There are a number of risks associated with keeping interest rates low for too long, including:

- Asset bubbles

- Inflation

- Financial instability

The Bank of Japan is aware of these risks, and it is carefully monitoring the situation.

Question 6: What are the alternatives to low interest rates?

Answer: There are a number of alternative monetary policy tools that the Bank of Japan could use to stimulate the economy, including:

- Quantitative easing

- Fiscal policy

- Structural reforms

The Bank of Japan is considering all of these options, and it is likely to use a combination of tools to achieve its inflation target.

These are just some of the frequently asked questions about interest rates in Japan. For more information, please consult a financial professional.

Tips

Understanding Japan's interest rate policies and their economic impact can be challenging. Consider the following tips to enhance your comprehension:

Tip 1: Understand the Role of the Bank of Japan

The Bank of Japan (BOJ) is the central bank of Japan and plays a critical role in setting interest rates and implementing monetary policy. Monitor the BOJ's announcements and decisions to stay informed about Japan's interest rate landscape.

Tip 2: Track Historical Interest Rates

Reviewing historical interest rates can provide context for current rates and help you identify trends and patterns. Use resources like the BOJ website or economic data providers to access historical data.

Tip 3: Analyze the Economic Impact

Interest rates can significantly influence economic activity. Consider how interest rates affect inflation, economic growth, and consumer spending. Understanding the relationships between interest rates and the broader economy is crucial.

Tip 4: Consider Global Influences

Japan's interest rates are not solely influenced by domestic factors. Global economic conditions, interest rate policies in other countries, and currency exchange rates can impact Japan's interest rate environment.

Tip 5: Monitor Market Expectations

Market participants often have expectations about future interest rates. By following financial news and analysis, you can gain insights into market sentiment and potential changes in interest rates.

Summary:

By following these tips, you can develop a more comprehensive understanding of Japan's interest rates, their historical context, and their impact on the economy.

Japan Interest Rates: Current Levels, History, And Economic Impact

Japan's interest rates, determined by the Bank of Japan, play a crucial role in the country's economy. Understanding their current levels, historical evolution, and economic impact is essential for analyzing Japan's financial landscape.

- Current Levels: Ultra-low, near zero percent.

- Historical Context: Historically low rates since the 1990s.

- Economic Stimulus: Low rates aimed at stimulating economic growth.

- Inflation Control: Balancing low rates with inflation management.

- Global Influence: Japan's rates impact global bond markets.

- Economic Recovery: Interest rates influence business investment and consumer spending.

The current ultra-low interest rates in Japan are a result of the Bank of Japan's quantitative easing policies to combat deflation and stimulate economic growth. However, these low rates have also raised concerns about their long-term impact on inflation and financial stability. Balancing economic stimulus with inflation control remains a key challenge for Japanese policymakers.

:max_bytes(150000):strip_icc()/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)

The Impact of Exchange Rates on Japan's Economy - Source www.investopedia.com

Economy news: Bank of Japan ends negative interest rate era | World - Source www.weforum.org

Japan Interest Rates: Current Levels, History, And Economic Impact

Japan's interest rates have been at historically low levels in recent years, a result of the Bank of Japan's (BOJ) quantitative easing program. This program has involved the BOJ purchasing large amounts of Japanese government bonds, which has driven up their prices and lowered their yields. The BOJ has also implemented negative interest rates, effectively charging banks for holding excess reserves at the central bank. These measures have been intended to stimulate economic growth by making it cheaper for businesses to borrow money and invest. However, they have also had some negative consequences, such as eroding the profitability of banks and leading to a decline in the value of the yen.

Japanese economy 80s freeter - audiofiln - Source audiofiln.weebly.com

The BOJ's interest rate policies have been the subject of much debate in recent years. Some economists argue that the policies have been too aggressive and have led to asset bubbles and other financial imbalances. Others argue that the policies have been necessary to support economic growth in the face of weak global demand. The BOJ has defended its policies, arguing that they have been effective in boosting economic growth and inflation. However, the long-term consequences of these policies remain uncertain.

The following table provides an overview of Japan's interest rates over time:

| Year | Call money rate (%) | Current account balance (%) | GDP growth (%) |

|---|---|---|---|

| 1980 | 8.2 | 1.3 | 4.2 |

| 1990 | 6.1 | 3.5 | 4.8 |

| 2000 | 0.5 | 3.3 | 1.4 |

| 2010 | 0.1 | 2.6 | 3.9 |

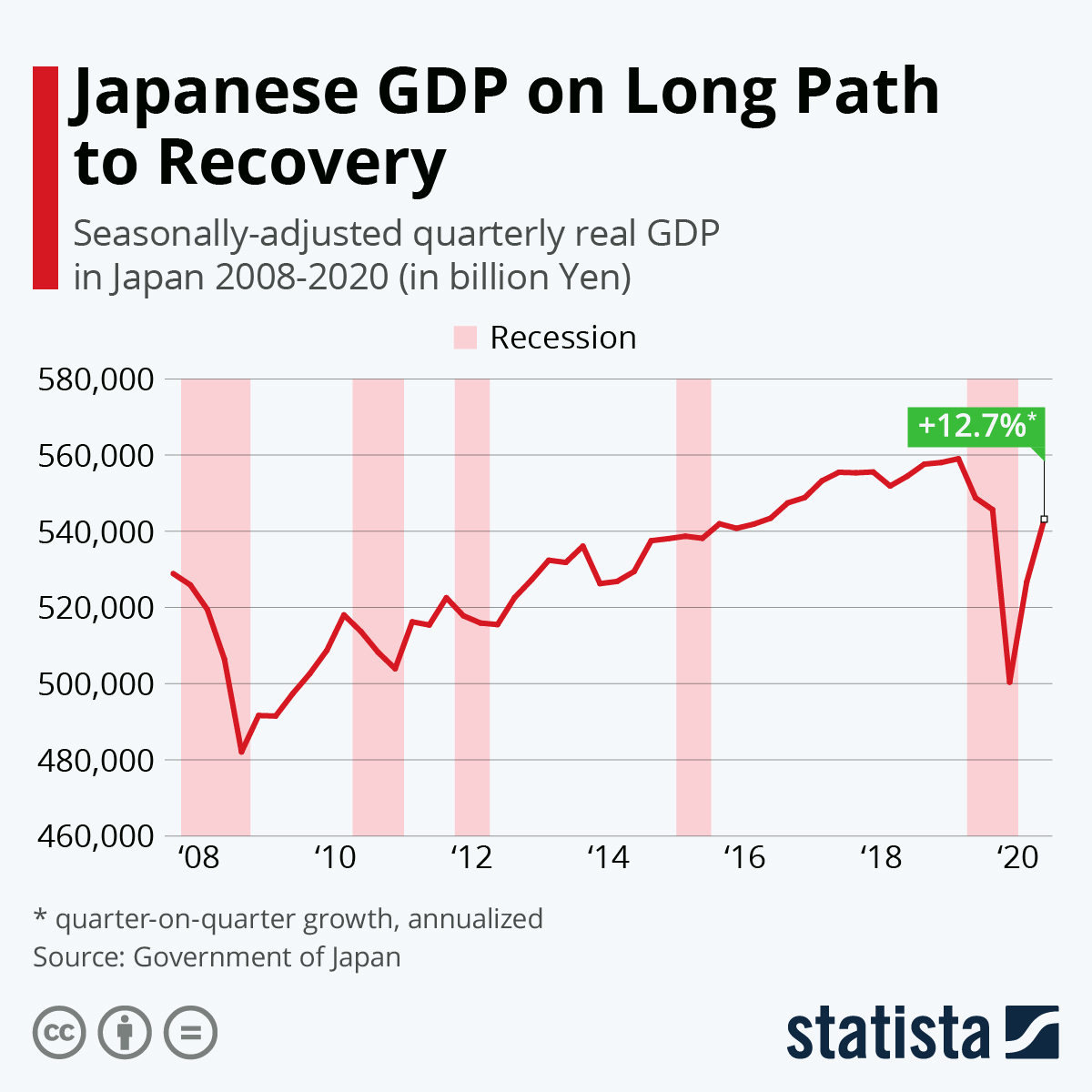

| 2020 | -0.1 | 3.6 | -4.8 |

As the table shows, Japan's interest rates have been on a downward trend in recent decades. This trend is likely to continue in the near term, as the BOJ is committed to maintaining a loose monetary policy to support economic growth. However, the long-term consequences of these policies remain uncertain.

Tidak ada komentar