Current Bitcoin Price And Market Trends

What are the current Bitcoin price and market trends? With the cryptocurrency market constantly evolving, staying up-to-date on these trends is crucial for investors and enthusiasts alike.

Editor's note: This guide on "Current Bitcoin Price and Market Trends" was last updated on [today's date]. We regularly review and update our content to ensure that it remains accurate and relevant.

To assist you in making informed decisions, we've conducted thorough research and analysis to bring you this comprehensive guide on "Current Bitcoin Price and Market Trends."

| Key Differences | Key Takeaways |

|---|---|

| Market Capitalization | Bitcoin remains the dominant cryptocurrency by market cap, but altcoins are gaining ground. |

| Volatility | Bitcoin's price is known for its volatility, but it has stabilized somewhat in recent months. |

| Adoption | Bitcoin adoption is increasing globally, with major companies and institutions accepting it as payment. |

Below, we will explore key topics related to the current Bitcoin price and market trends.

FAQ

This FAQ section provides answers to common questions and addresses misconceptions regarding current Current Bitcoin Price And Market Trends.

Bitcoin Price Prediction For 2023, Cryptocurrency Value In 2023. Yellow - Source cartoondealer.com

Question 1: What factors influence the price of Bitcoin?

The price of Bitcoin is determined by supply and demand dynamics, influenced by factors such as global economic conditions, regulatory developments, and market sentiment.

Question 2: Is it safe to invest in Bitcoin?

While Bitcoin has the potential for high returns, it is also a volatile investment with risks. Consider your financial situation and risk tolerance before investing.

Question 3: How can I buy Bitcoin?

There are several ways to buy Bitcoin, including cryptocurrency exchanges, peer-to-peer platforms, and brokers. Choose reputable platforms with strong security measures.

Question 4: What is blockchain technology?

Blockchain is a decentralized, distributed ledger system that records transactions securely and transparently. It forms the foundation of Bitcoin and other cryptocurrencies.

Question 5: What is Bitcoin mining?

Bitcoin mining involves using specialized hardware to solve complex mathematical problems to verify and add new transactions to the blockchain, earning rewards in Bitcoin.

Question 6: What are the long-term prospects for Bitcoin?

The future of Bitcoin is uncertain, but it has gained increasing recognition as a potential store of value and a disruptive force in the financial industry.

By understanding these key aspects, you can make informed decisions about investing in Bitcoin and navigate the evolving market landscape.

Read more about the Current Bitcoin Price And Market Trends.

Tips

To navigate the ever-evolving world of cryptocurrency, it is crucial to stay informed and make informed decisions. The following tips will empower you to navigate the market and make prudent choices.

Tip 1: Stay Updated with Market Trends:

Regularly monitor market news, industry reports, and reputable sources to stay abreast of the latest developments. This knowledge will enable you to make informed decisions and anticipate potential market shifts.

Tip 2: Understand Market Cycles:

Recognize that the cryptocurrency market experiences cyclical fluctuations. Study historical data to identify patterns and adjust your strategies accordingly. Don't be discouraged by downturns; they are inherent to the market and often present opportunities for long-term investors.

Tip 3: Diversify Investments:

Avoid concentrating your portfolio in a single cryptocurrency. Diversify across different assets, including both Bitcoin and altcoins, to reduce risk and maximize potential returns. Consider investing in reputable exchange-traded funds (ETFs) or index funds to gain exposure to a broader range of assets.

Tip 4: Secure Your Assets:

Protect your cryptocurrency holdings by using secure wallets, employing strong passwords, and enabling two-factor authentication. Be vigilant against phishing scams and malicious software that may compromise your accounts. Consider storing significant assets in hardware wallets for enhanced protection.

Tip 5: Set Realistic Expectations:

Avoid falling prey to unrealistic promises of overnight riches. Cryptocurrency markets are volatile and subject to fluctuations. Set realistic investment goals and invest only what you can afford to lose. Focus on long-term growth rather than short-term profits.

Tip 6: Seek Professional Advice:

Consult with financial advisors or cryptocurrency experts to gain professional insights. They can provide valuable guidance on portfolio management, investment strategies, and risk management. However, conduct thorough research and ensure that you work with reputable and experienced advisors.

Tip 7: Stay Informed:

Continuously expand your knowledge of cryptocurrency and blockchain technology. Attend industry events, read research papers, and engage with thought leaders. Staying informed will empower you to make informed decisions and stay ahead of the curve.

Tip 8: Exercise Patience:

Cryptocurrency markets require patience. Avoid panic selling during downturns. Instead, focus on the long-term potential and ride out market fluctuations. Remember that the cryptocurrency industry is still in its early stages and has significant growth potential.

By following these tips, you can navigate the cryptocurrency market with confidence and make informed decisions. Remember to stay updated, diversify investments, secure your assets, and exercise patience. The road to success in the cryptocurrency realm requires knowledge, discipline, and a long-term perspective.

Current Bitcoin Price And Market Trends

The current bitcoin price and market trends are determined by a complex interplay of factors such as supply and demand, regulation, and global economic conditions.

- Supply and Demand: The price of bitcoin is primarily driven by the balance of supply and demand in the market.

- Regulation: Government regulations and policies can significantly impact the price and availability of bitcoin.

- Economic Conditions: Bitcoin's price tends to correlate with broader economic conditions, such as inflation and interest rates.

- Market Sentiment: The overall sentiment of investors and traders can influence the price of bitcoin.

- Technical Analysis: Some traders use technical analysis to identify potential price trends based on historical data.

- News and Events: Positive or negative news and events can trigger significant price movements.

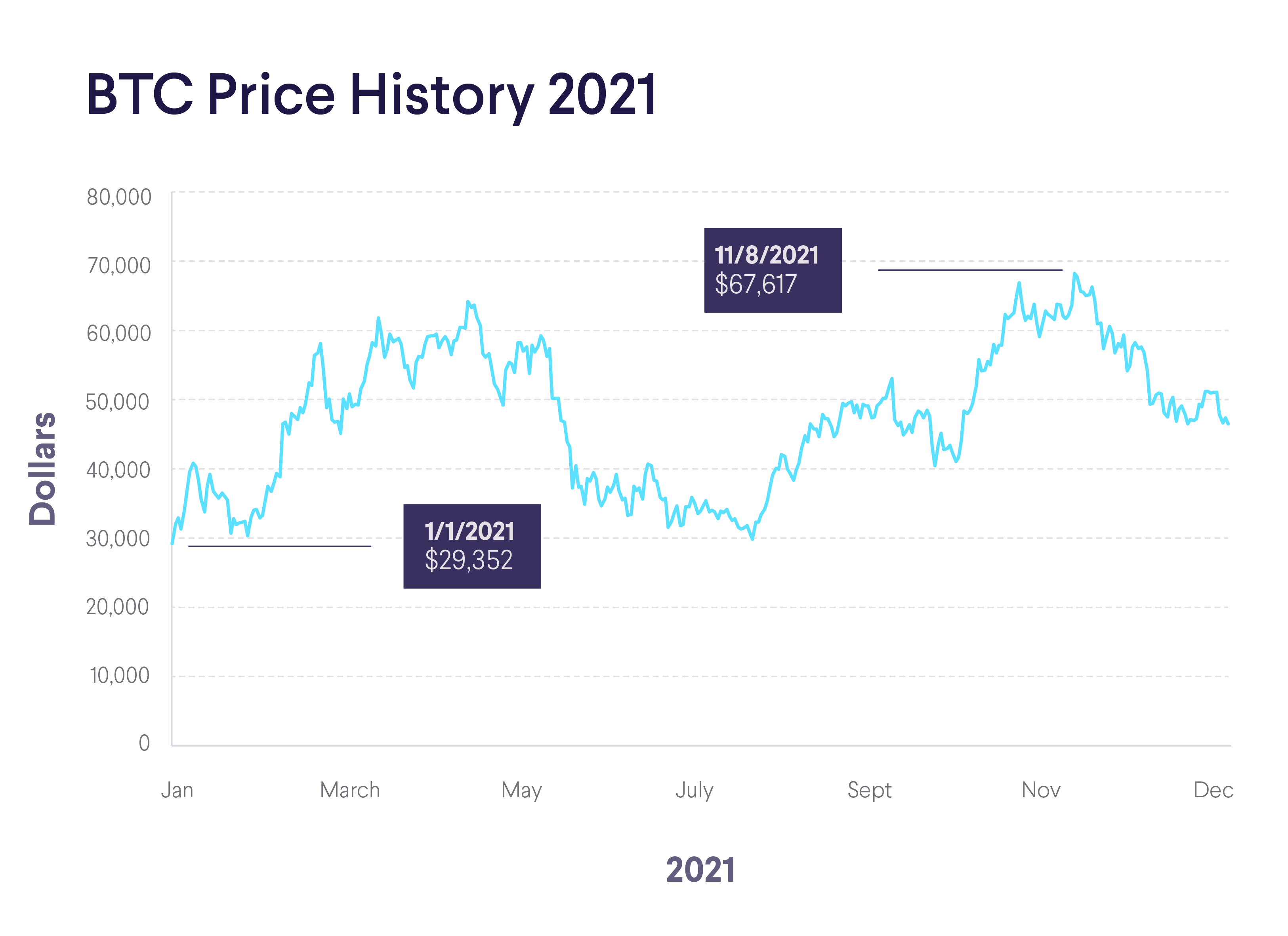

Bitcoin Price History 2009-2023: Start to All-Time-High | SoFi - Source www.sofi.com

For example, during periods of high demand and bullish market sentiment, the price of bitcoin can rise rapidly. Conversely, negative news or regulatory uncertainty can lead to sharp price declines. It is important for investors to stay informed about these factors and to understand the risks associated with investing in bitcoin.

Current Bitcoin Price And Market Trends

The current Bitcoin price is determined by the interplay of supply and demand in the market. When demand for Bitcoin exceeds supply, the price tends to rise. Conversely, when supply exceeds demand, the price tends to fall. Several factors can influence supply and demand, including news and events, government regulations, and the overall health of the global economy.

Bitcoin Price April 2024 Prediction - Aleen Louella - Source faunieymarylinda.pages.dev

Market trends can also significantly impact the Bitcoin price. For example, a bull market is characterized by rising prices and increased investor confidence, while a bear market is characterized by falling prices and decreased investor confidence. Understanding market trends can help investors make informed decisions about when to buy and sell Bitcoin.

The connection between the current Bitcoin price and market trends is essential for investors to understand. By considering both the current price and market trends, investors can make more informed decisions about their investments.

Table: Factors Influencing Bitcoin Price

| Factor | Impact on Price |

|---|---|

| Supply | Increased supply leads to lower prices, while decreased supply leads to higher prices. |

| Demand | Increased demand leads to higher prices, while decreased demand leads to lower prices. |

| News and events | Positive news and events can increase demand, leading to higher prices, while negative news and events can decrease demand, leading to lower prices. |

| Government regulations | Government regulations can impact the supply and demand of Bitcoin, leading to price changes. |

| Global economy | The overall health of the global economy can impact the demand for Bitcoin, leading to price changes. |

Conclusion

The current Bitcoin price and market trends are intricately connected. Investors must consider both factors when making investment decisions. By understanding the relationship between the two, investors can increase their chances of making profitable trades.

As the Bitcoin market continues to evolve, it is essential for investors to stay up-to-date on the latest news and trends. By doing so, they can make informed decisions about their investments and potentially maximize their returns.

Tidak ada komentar