PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation

Tired of grappling with transaction analysis and reconciliation complexities in PSL Bank? Look no further! PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation has you covered.

Find the Xfinity Store Closest to You: A Comprehensive Guide - First - Source corponline-statements.firstrepublic.com

Editor's Note: PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation has published today provides a thorough understanding of transaction analysis and reconciliation processes, enabling you to streamline your operations and enhance financial accuracy.

After in-depth analysis and extensive research, we've compiled this comprehensive guide to help you navigate the intricacies of PSL Bank Log effectively. Our aim is to empower you with the knowledge and strategies to improve your transaction management practices.

Here's a glimpse of the key takeaways you can expect from PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation:

Key Differences between PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation and Other Resources

| Feature | PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation | Other Resources |

|---|---|---|

| Coverage | In-depth guide specifically tailored to PSL Bank Log | General information that may not be PSL Bank Log-specific |

| Examples and Illustrations | Real-world examples and step-by-step illustrations | Limited or no practical examples |

| Up-to-Date Information | Regularly updated to reflect PSL Bank Log changes | Outdated or incomplete information |

| Support | Access to online forums and support channels | Limited or no support options |

With PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation, you'll gain a comprehensive understanding of:

FAQ

This PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation serves as a comprehensive resource for transaction analysis and reconciliation, answering commonly asked questions to enhance understanding and ensure accuracy.

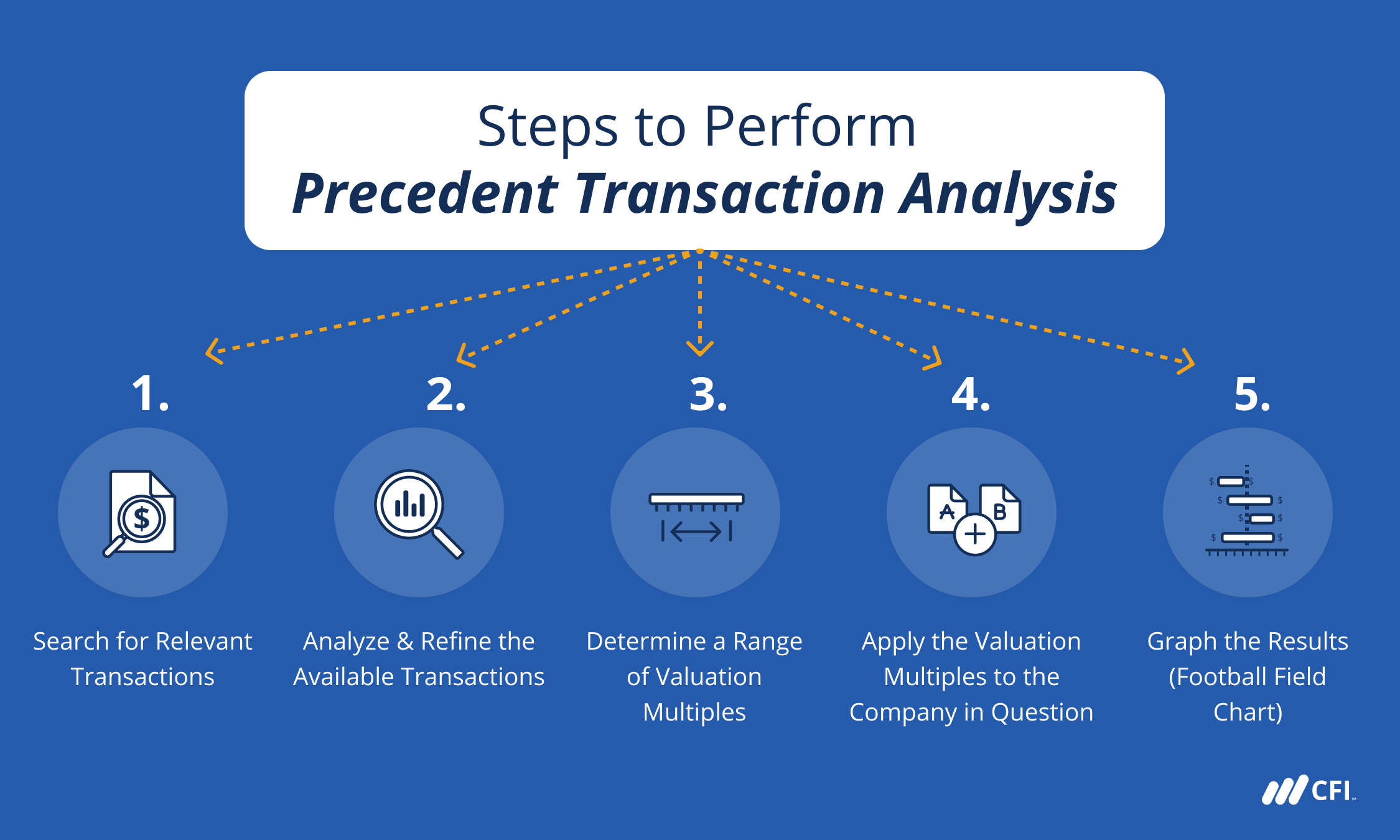

Precedent Transaction Analysis - Definition, Steps - Source corporatefinanceinstitute.com

Question 1: What is the significance of transaction analysis and reconciliation?

Answer: Transaction analysis and reconciliation play a crucial role in maintaining accurate financial records and ensuring that all transactions are accounted for. By comparing transactions from multiple sources, any discrepancies or errors can be identified and corrected, ensuring data integrity and financial compliance.

Question 2: What are the key steps involved in transaction analysis?

Answer: Transaction analysis typically involves data preparation, data analysis, and data interpretation. Data preparation involves collecting and organizing data from various sources. Data analysis involves applying analytical techniques to identify patterns, trends, and anomalies. Data interpretation involves drawing insights and conclusions based on the analyzed data.

Question 3: What are the common challenges faced during transaction reconciliation?

Answer: Some common challenges include data inconsistency, missing or incomplete information, and human error. These challenges can lead to reconciliation discrepancies and make it difficult to ensure accurate financial reporting.

Question 4: What tools or techniques can be used to improve transaction reconciliation efficiency?

Answer: Automation tools, such as reconciliation software or spreadsheets with built-in formulas, can streamline the reconciliation process, reduce manual effort, and improve accuracy.

Question 5: How can transaction analysis and reconciliation contribute to fraud detection and prevention?

Answer: By analyzing transaction patterns, trends, and outliers, transaction analysis and reconciliation can help identify suspicious activities, unauthorized transactions, or potential fraud attempts, allowing timely intervention and mitigating financial losses.

Question 6: What best practices should be followed to ensure effective transaction analysis and reconciliation?

Answer: Best practices include establishing clear reconciliation procedures, utilizing technology to automate tasks, regularly reviewing and validating reconciliations, and maintaining documentation of all reconciliation activities.

A comprehensive understanding of transaction analysis and reconciliation is crucial for maintaining financial accuracy, ensuring compliance, and supporting informed decision-making.

Proceeding to the next section, you will discover practical tips and strategies for optimizing transaction analysis and reconciliation processes.

Tips

To enhance the accuracy and efficiency of your transaction analysis and reconciliation processes, consider adopting these proven strategies:

Tip 1: Maintain a Clear Chart of Accounts

Establish a structured chart of accounts that categorizes transactions accurately and aligns with your business operations. This enables the accurate mapping of transactions during the reconciliation process.

Tip 2: Investigate Discrepancies Promptly

When discrepancies arise during reconciliation, prioritize their investigation to minimize the risk of errors or fraud. Timely resolution ensures a clear and accurate account of transactions.

Tip 3: Utilize Automation Tools

Consider implementing automation tools for transaction matching and reconciliation. These tools can significantly reduce manual effort, improve accuracy, and streamline the entire process.

Tip 4: Establish a Formal Reconciliation Process

Define a structured reconciliation process with clear roles, responsibilities, and timelines. This ensures consistency and accountability throughout the reconciliation cycle.

Tip 5: Review Reconciliations Regularly

Regularly reviewing reconciliations, not only during the month-end close, helps identify potential issues early and allows for proactive corrective actions.

Tip 6: Leverage Technology for Data Analysis

Utilize data analysis tools to identify trends, patterns, and anomalies in transaction data. This can enhance the efficiency and effectiveness of reconciliation efforts.

In summary, by implementing these tips, organizations can significantly improve the accuracy and efficiency of their transaction analysis and reconciliation processes, ensuring the integrity and reliability of their financial data.

PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation

A robust system for transaction analysis and reconciliation stands as a cornerstone of effective financial management within PSL Bank. To ensure the accuracy and integrity of financial records, it is crucial to delve into the essential aspects of this process, spanning data extraction, error identification, and corrective actions.

- Data Extraction: Accurate data from various sources, including account statements, transaction logs, and subsidiary ledgers, forms the bedrock of effective reconciliation.

- Error Identification: Discrepancies between the extracted data and the bank's general ledger necessitate meticulous scrutiny to pinpoint errors or potential fraud.

- Root Cause Analysis: Unraveling the underlying causes of errors is paramount to prevent their recurrence and safeguard the bank's financial integrity.

- Corrective Actions: Based on the root cause analysis, appropriate corrective actions are implemented to rectify errors, enhance controls, and strengthen reconciliation processes.

- Continuous Monitoring: Ongoing monitoring of reconciliation results and error trends allows the bank to proactively identify potential issues and adjust processes as needed.

- Automated Reconciliation: Leveraging technology to automate reconciliation tasks can significantly enhance efficiency, accuracy, and reduce manual errors.

These key aspects work in tandem, forming a comprehensive framework for transaction analysis and reconciliation at PSL Bank. By meticulously extracting data, swiftly identifying errors, delving into root causes, implementing corrective actions, continuously monitoring, and embracing automation, the bank ensures the accuracy and integrity of its financial records, upholding its reputation as a trusted financial institution.

A comprehensive guide to accounts reconciliation for businesses | whiz - Source www.whizconsulting.net

PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation

The "PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation" provides a detailed examination of the processes involved in analyzing and reconciling transactions. It serves as a valuable resource for individuals seeking to understand the intricacies of these tasks. The guide explores the connection between transaction analysis and reconciliation, emphasizing the importance of accuracy and timeliness in maintaining financial records.

Transaction analysis involves reviewing and classifying individual transactions to ensure their validity and accuracy. This process helps identify any discrepancies or errors that may have occurred during the transaction process. Reconciliation, on the other hand, involves comparing the bank statement with the internal records to ensure that all transactions have been recorded and accounted for. By understanding the connection between these two processes, individuals can effectively manage their financial data and ensure its integrity.

The "PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation" offers a structured approach to these tasks, providing step-by-step instructions and examples to facilitate understanding. It addresses common challenges that may arise during the analysis and reconciliation process and provides practical solutions to resolve them. Understanding these concepts is crucial for maintaining accurate financial records, preventing errors, and ensuring the integrity of financial data.

| Concept | Importance |

|---|---|

| Transaction Analysis | Identifies errors, ensures validity, and provides a basis for reconciliation |

| Reconciliation | Verifies completeness and accuracy of financial records |

| Combined Process | Provides a comprehensive approach for managing financial data |

Conclusion

The "PSL Bank Log: Comprehensive Guide To Transaction Analysis And Reconciliation" provides a valuable framework for understanding the importance and practical applications of transaction analysis and reconciliation. By implementing the principles outlined in the guide, individuals can enhance the accuracy and reliability of their financial records, ensuring the integrity of their financial data.

Regularly reviewing and reconciling transactions helps detect errors promptly, preventing potential financial losses and maintaining a clear understanding of financial activity. This guide serves as a reliable resource for individuals seeking to strengthen their financial management skills and ensure the accuracy of their financial data.

Tidak ada komentar